The True Cost of Spam and Scam Calls in America

Lindsey LaMont

Mar 12, 20246 min read

It’s time for the 9th edition of the Truecaller Insights U.S. Spam & Scam Report. Phone scams are relentless and the numbers don’t lie. A staggering 56.2 million U.S. Adults were impacted by the spam and scam call epidemic in 2023. Please read on for further findings.

Access the full report at: https://tclr.se/3PhMC9Q

Preventing Spam: The Truecaller Approach

At Truecaller, we're proud to offer a spam-blocking solution we consider unparalleled. Our approach combines the robustness of a community-driven system with the sophistication of advanced machine learning algorithms, ensuring superior protection for users globally. Experience has taught us that scammers and spammers are incredibly adept at navigating around new regulations and laws. This adaptability means there's no simple shortcut to eliminating scams. However, by leveraging the collective strength of a community like Truecaller's, we believe we can offer a formidable defense against these unwanted intrusions.

Key findings from the 2024 report:

- Over 56.2 million U.S. Adults were impacted by the spam and scam call epidemic in 2023.

- 1 in 4 Americans reported losing an average of $452 to scams, totalling over $25.4 billion.

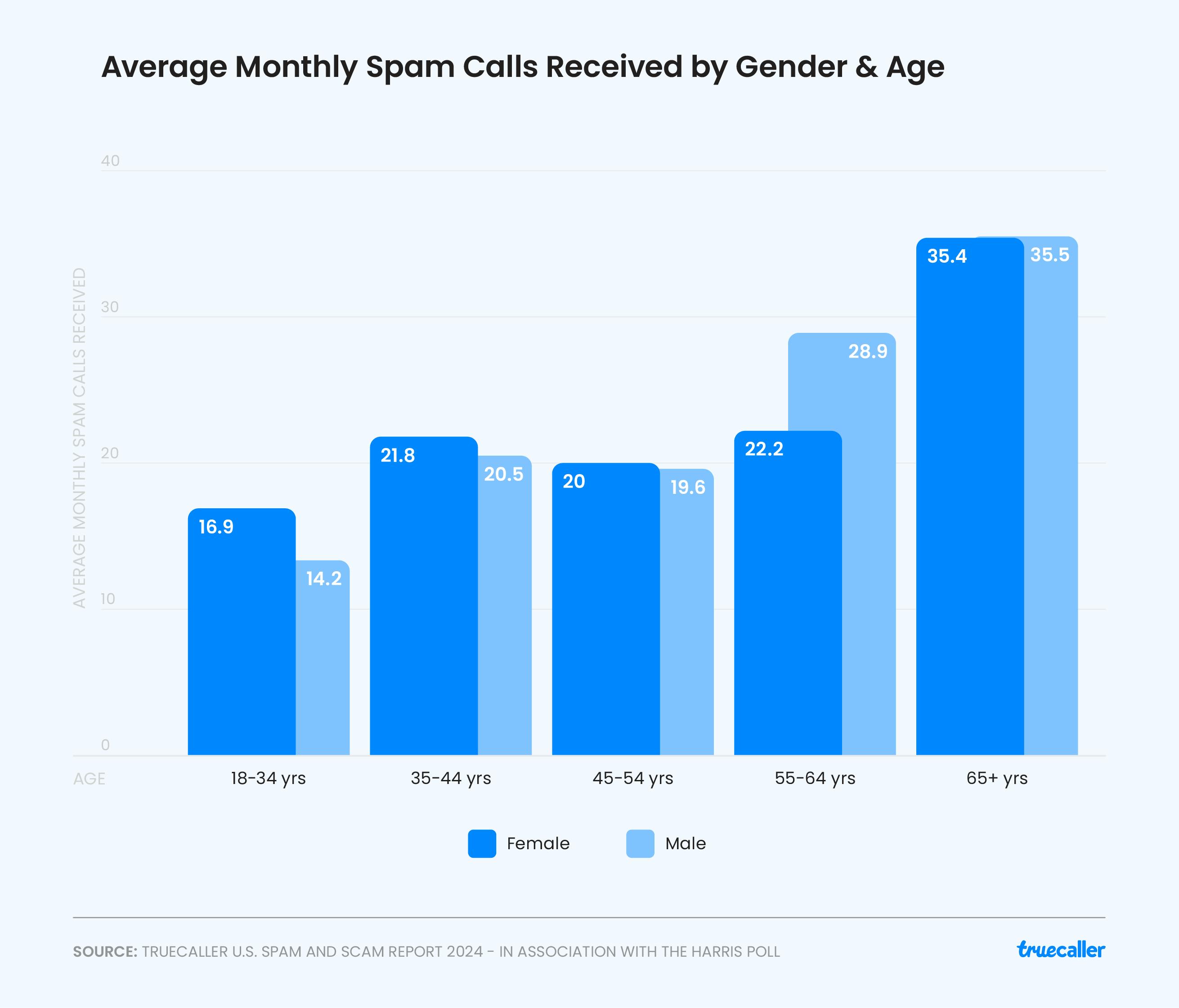

- Younger adults ranging from 18-44 years are at three times the risk of older adults.

- Seniors are still disproportionately targeted by fraudsters.

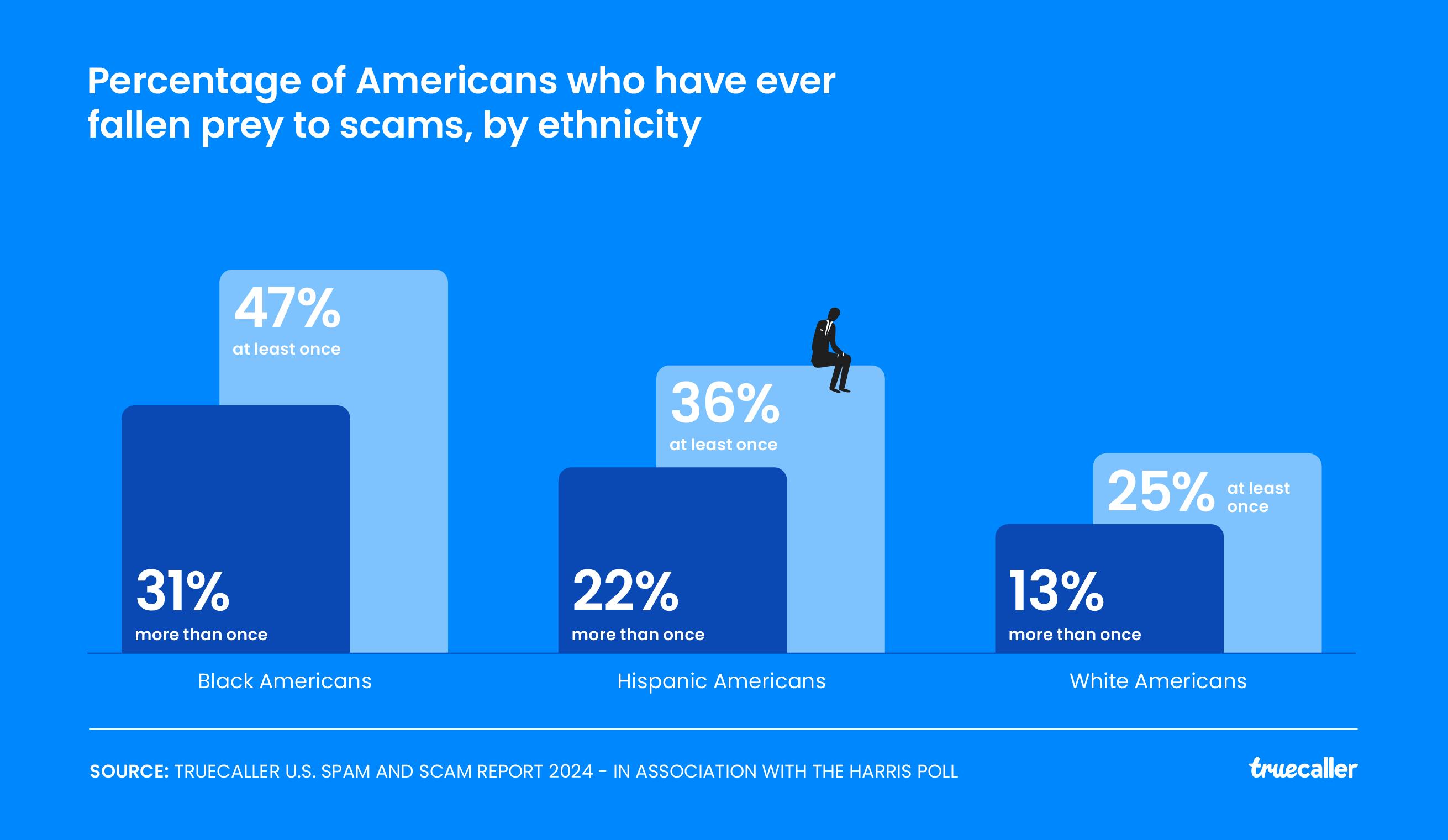

- Black Americans and Hispanic communities were twice as likely to be scammed compared to White Americans. (39%, 30%, respectively vs 15%)

- Regulatory and mitigation efforts have helped decrease massive robocall campaigns by 18% YoY.

- Artificial Intelligence is increasingly being used to make these scam calls and script scam texts, making them sound more realistic and effective.

The Truecaller U.S. Spam and Scam Report 2024, developed in collaboration with The Harris Poll, provides a comprehensive overview of the current state and impact of spam and scam calls on American consumers. Despite efforts by regulators, enforcement agencies, and carriers to combat the issue through technologies like STIR/SHAKEN and aggressive enforcement against offenders, the problem persists, with Americans still facing substantial financial losses totaling approximately $25.4 billion annually. This reflects the ongoing challenge of mitigating robocall volumes and consumer fraud.

In 2023, there has been a shift in scam tactics, with a move away from large-scale robocall campaigns to more sophisticated, AI-driven spearfishing attacks that are highly targeted and contextually relevant. These precision-targeted campaigns pose a significant threat due to their effectiveness, even at lower volumes, and have the potential to exploit the increased mobile targeting associated with election cycles.

Key findings from the survey reveal that over 56.2 million U.S. adults were affected by spam and scam calls in the past year, with a collective loss of $25.4 billion. The average financial loss per victim was approximately $452.

Hispanic and Black Americans were twice as likely to lose money to phone scams

There’s also a difference in the kind of scams targeting different ethnicities. Spam calls and text messages targeting White Americans were skewed towards fraudulent delivery updates, vehicles and political communications. Hispanic Americans (30%) received more suspicious communications about student loans vis-a-vis White Americans. In comparison, more Black Americans (24%) were targeted with communications around electronic deals compared to White Americans (17%).

In particular, vulnerability of younger demographics and the strategies employed by scammers to exploit this group, including multiple victimizations and leveraging the relatively lower guard of younger individuals against unsolicited calls and messages.

When it comes to age and gender disparities in scam victimization, younger adults (18-44 years) being three times more at risk than older adults, and communities of color, particularly Black and Hispanic Americans, being disproportionately targeted and affected by these scams.

Scam Targeting Increases by Age

Young adults are still losing a lot of money to scams.

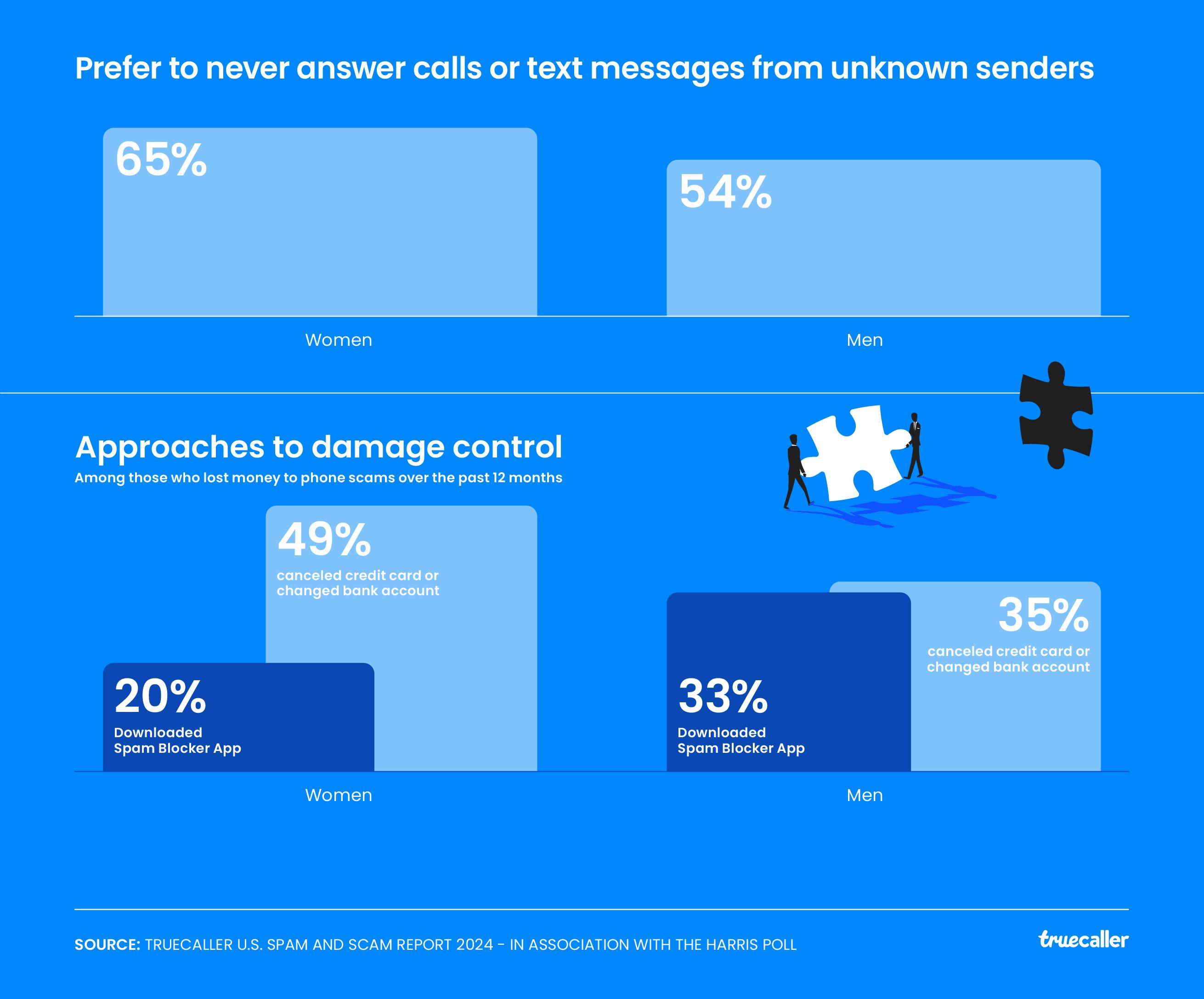

Interestingly, the report also sheds light on the ethnic and gender divides in scam targeting and victimization, with notable differences in the types of scams, frequency of targeting, and financial losses among different racial groups and between men and women. It appears that spam and scam calls are not only a financial burden but also contribute to a trust deficit in phone-based communications, affecting the fundamental way individuals interact with calls and messages.

Our Text Inboxes Are Getting Noisy & Cluttered

The societal impact of spam calls extends beyond financial loss, creating significant disruptions in communication and leading to missed important calls due to mistrust of unknown numbers. This growing communication gap is exacerbated by the widespread fear of AI-generated scam calls, with a notable portion of the population expressing concern over these advancements in scam tactics.

To counteract these issues, advocate for increased awareness and adoption of tools like spam blockers, and caller ID apps, which can help rebuild trust in phone communications. Truecaller is a solution in this fight against spam and scam calls. Our community-led approach combined with advanced machine learning and AI technologies to offer the best protection for Americans, and people around the world.

The Truecaller Way: How to Best Prevent Spam and Being Scammed

While there is no silver bullet, here is a list of defenses against communications fraud

- Download a trusted Caller ID application like Truecaller and do not respond to calls and SMS that are marked as Spam and Fraud by the community. Make sure to only download the app from trusted sources: Google Play Store, Apple App Store or from links placed on Truecaller’s website.

- Phone and SMS scams will typically try to add some urgency to get you to respond without thinking. Take your time and verify the sender and information before responding.

- Stay aware of the most common types of scams in the U.S., as updated regularly by the Consumer Financial Protection Bureau (CFPB) here.

- Do not click on unknown links that you receive via SMS. Especially if it is related to financial matters. If in doubt, it is better to call the financial institution that the SMS is from or visit their website directly instead of clicking on the SMS link.

- Delete suspicious SMS and emails immediately to avoid any spyware and fraud.

- Never share sensitive information like your Social Security, user IDs or usernames, passwords, credit card numbers or any other financial information over a phone call or SMS. Bank officials, financial institutions or regulators will never ask you for this information.

- Never download mobile applications from unverified and unknown sources - especially not from a link you get or if someone calls you and asks you to download something.

- Do not fall for offers made by people who claim to represent a company - especially if they are calling from personal phone numbers.

If You or Someone You Know Is Affected by Scam, Here’s What to do

- Report it to your local police or Sheriff’s office.

- File a complaint with the Federal Trade Commission.

- Visit the Federal Bureau of Investigation’s (FBI) Scams and Safety page on reporting suspicious activities online.

- Advise them to prevent future incidents by downloading an app like Truecaller.

Methodology

The Scam Survey was conducted online within the United States by The Harris Poll on behalf of Truecaller between January 9-11, 2024, among 2,074 adults ages 18, among whom 420 lost money due to a phone scam in the past 12 months. The Spam Survey was conducted online within the United States by The Harris Poll on behalf of Truecaller between January 10-12, 2024, among 2,080 adults ages 18.

Data were weighted where necessary by age, gender, race/ethnicity, region, education, marital status, household size, household income, and political party affiliation, to bring them in line with their actual proportions in the population.

Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 2.5 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments. If you have more questions about the methodology or need additional press assets, please contact press@truecaller.com.

Lindsey LaMont

Mar 12, 20246 min read