Cryptocurrency Scams

What are cryptocurrency scams?

In a cryptocurrency scam, cyber criminals deceive victims into investing in fake cryptocurrency-related opportunities by presenting manipulated data and charts that promise high profits and low risks. The scammers use fraudulent websites and apps that mimic legitimate cryptocurrency platforms but are fully under their control. They reach out to victims through various channels, including social media, messaging apps, dating websites, job websites, emails, or phone calls. Once victims invest their money, the scammers disappear with the funds. Countries like the USA, India, South Korea, UK, Germany, Italy, Spain, Cambodia and Nigeria have been affected by cryptocurrency scams.

In February 2025, an Indian medical student was contacted by crypto scammers through Telegram. The scammers worked on building a rapport with the student by educating him on investment strategies. He ended up investing a total of 44 lakh rupees (around 52,000 USD), only for the scammers to disappear with all of his money.

A 51 year old woman in Michigan, USA, got a fake text about a charge she didn’t make. When she called back, scammers tricked her into thinking that her money was in danger and needed to be secured immediately. They made her withdraw cash and deposit it into a bitcoin ATM. In the end, she lost her $17,500 tax refund and savings.

Modus operandi of cryptocurrency scammers:

Scammers contact victims through social media, messaging apps, emails, dating websites, job sites, or random texts.

To build trust, con artists craft convincing stories tailored to their target and the platform they’re using, carefully setting a trap to exploit the victim’s emotions and savings before suggesting ways to quickly grow their money.

One of the most common ways scammers bring up the topic of “investment” is by telling the victim that a relative or close friend is an expert investor or advisor who can double their money with little risk.

The victim is asked to open an account on the investment platform shared by the scammer and begin by investing small amounts.

The investment platform shared by the scammer is malicious and fully operated by them. It initially shows fake profits to the victim. Once the victim notices growth, they are encouraged to invest more and even make small withdrawals to build trust. All of this is a trap designed to lure the victim into investing large sums.

Once the victim deposits a large sum and tries to withdraw it, they are usually told that their account has been frozen or that they need to pay taxes to unlock their earnings. This is often when victims realize they have been scammed.

Types of cryptocurrency scams

Cyber criminals create malicious apps and websites that are almost indistinguishable from the real ones. They fool investors by promising high profits with little to no risk. Upon receiving the victim's money or stealing their personal data, the scammers vanish without a trace.

A cryptocurrency ponzi scheme is built around a new, unproven cryptocurrency. Profits from new investors are used to pay earlier investors, and the chain continues until it eventually collapses.

To earn credibility and leverage a celebrity’s fan following, scammers use videos of celebrities and manipulate them using AI to make it seem like the celebrity is personally encouraging people to invest in a particular cryptocurrency. These fake videos are often circulated on social media, attracting the attention of curious individuals hoping to quickly grow their money.

Scammers often target potential victims on dating websites by creating fake profiles. Once they match with someone, they eventually bring up a “great investment opportunity” they say they recently discovered. Trusting individuals fall for this trap, leading to not only huge financial losses but also heartbreak.

Cryptocurrency scammers often approach victims with fake job opportunities through direct messages or emails. Desperate job seekers respond with enthusiasm, only to later discover they are asked to pay for training using cryptocurrency.

In other cases, victims are given tasks and promised a salary but are required to deposit their own money first to complete the work. Initially, victims earn profits and they are asked to deposit more to earn big profits. Once a large sum is deposited, scammers stop all communication with them. Victims try to withdraw their money but they are asked to pay taxes to be able to access the money.

One common tactic scammers use is impersonating a government official and threatening their targets with consequences like missing jury duty or failing to file taxes on time, pressuring them to pay a fine using cryptocurrency.

How to protect yourself from a cryptocurrency scam?

Cryptocurrency scams are widespread and in constant flux with new strategies to scam people. Here are a few simple steps that can save a lot of your money and time:

- Promise of unusually high profit: If someone promises unusually high profits with little investments, proceed with caution. These claims are often baseless and designed to lure you into a scam. Profits from crypto investments are never guaranteed.

- Beware of fake apps and websites: If someone sends you a link to download an app or visit a website, always check the URL carefully. Make sure to download apps only from trusted sources like official app stores.

- Use secure crypto platforms: Use only verified crypto exchanges and wallets instead of clicking on random links sent through emails, texts, or DMs, which can lead you into trouble.

- Never share your private key: Only scammers will ask for this information, never a legitimate organization or person.

- Do not trust social media profiles: Celebrity endorsements, misleading social media profiles, or people claiming to have made millions just by downloading an app and creating an account, these are some of the many tactics scammers use to deceive people on social media. Don’t trust such claims; they are deceptive and designed to steal your hard-earned money. Always do your research before investing.

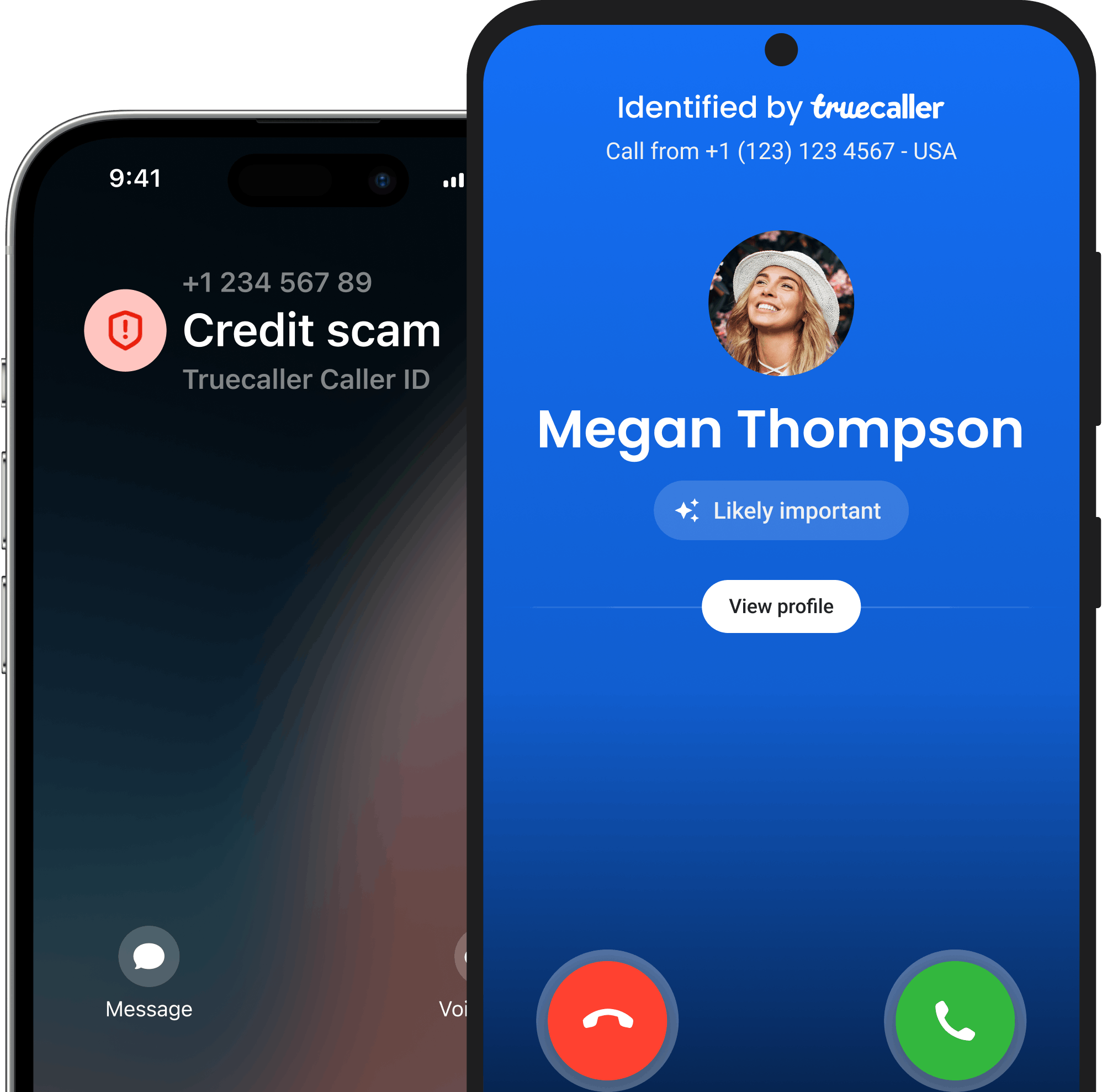

- Download the Truecaller app: Truecaller serves as your first line of defense against scammers. It flags and blocks phone calls and SMS messages from known spam numbers, helping to protect you from fraudulent activity.

What to do if you are a victim of a cryptocurrency scam?

If you have fallen victim to a cryptocurrency scam, take the following steps immediately to avoid further damage:

- Document everything: Keep screenshots of texts, whatsapp messages, emails. The evidence might help the authorities in tracking down the criminals

- Contact your bank: Immediately inform the bank about the transaction, no matter what mode of payment you have used.

- Protect your accounts: Change passwords and PINs for all the accounts that have been compromised. Enabling two-factor authentication can add an additional layer of protection to your account.

- Monitor bank accounts: Keep monitoring your bank accounts and report in case you spot any unauthorized transaction

- Report the phone number on Truecaller: Truecaller is a community-based app that relies on the trust and prompt reporting of phone numbers by victims to prevent others from falling into the same trap. Make sure to flag the scammer’s phone number in the app as soon as possible.

Where to report a cryptocurrency scam?

If you are in the United States, these could be some agencies you could reach out to:

- Federal trade commission: https://consumer.ftc.gov/features/pass-it-on/charity-fraud

- Internet crime complaint centre: https://www.ic3.gov/

Reporting the scam on Truecaller will help prevent others from becoming victims.

- For immediate assistance and guidance on cyber fraud, call 1930 (toll-free)

- Serious Fraud Investigation Office: https://sfio.gov.in/

- Chakshu - Report suspected fraud communication:

https://services.india.gov.in/service/detail/chakshu-report-suspected-fraud-communication

- Sanchar Saathi: https://sancharsaathi.gov.in/sfc/Home/sfc-complaint.jsp

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Police Special Fraud Unit (PSFU)

Email: report@specialfraudunit.org.ng, pro@specialfraudunit.org.ng

Whatsapp: 08127609914

Voice Call/SMS: 07082276895

Social Media: Facebook - Economic and Financial Crimes Commission (EFCC)

Email: info@efcc.gov.ng

Phone number: +234 8093322644, +234 (9) 9044751

Social Media: Facebook, Twitter, Instagram - Independent Corrupt Practices Commission (ICPC)

Email: info@icpc.gov.ng

Phone number: 08076369259, 08076369260

Social Media: Instagram, Twitter, Facebook

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Action fraud: https://www.actionfraud.police.uk/charities

- Fundraising regulator: https://www.fundraisingregulator.org.uk/complaints

- GOV.UK: https://www.gov.uk/report-suspicious-emails-websites-phishing

- National cyber security centre: https://www.ncsc.gov.uk/

Reporting the scam on Truecaller will help prevent others from becoming victims.

- CSA Singapore: https://www.csa.gov.sg/cyber-aid

- File a police report at https://eservices1.police.gov.sg

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Scamwatch: https://www.scamwatch.gov.au/

- Email: ReportScams@ato.gov.au

- Scam helpdesk: https://www.servicesaustralia.gov.au/phone-us?context=64107#scams

Reporting the scam on Truecaller will help prevent others from becoming victims.

- South African Fraud Prevention Service: https://cybercrime.org.za/reporting

- Internet Service Providers’ Association (ISPA): https://ispa.org.za/safety/report-cybercrime/

- In case of SIM fraud, please contact your mobile service provider

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Online: Cybercrime Investigation Unit (Korean National Police Agency) https://cyberbureau.police.go.kr/eng/index.do

- Phone: 182

- Korea Internet & Security Agency (KISA) – Cyber Incident Response Center: https://www.krcert.or.kr

- Phone: 118 (Cybercrime and Online Fraud Hotline)

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Office of cybercrime: https://cybercrime.doj.gov.ph/contact-us-2/

- Email: cybercrime@doj.gov.ph

- National Bureau of Investigation (NBI) – Cybercrime Division: https://nbi.gov.ph/

- Philippine National Police (PNP) – Anti-Cybercrime Group: https://acg.pnp.gov.ph/

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Canadian Anti-Fraud Centre (CAFC): https://antifraudcentre-centreantifraude.ca/report-signalez-eng.htm

- Local police (non emergency line)

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Federal Criminal Police Office (Bundeskriminalamt - BKA): https://www.polizei.de/Polizei/DE/Einrichtungen/ZAC/zac_node.html

- Local police

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Online: https://www.service-public.fr

- Phone: Call 17 or go to the nearest police station

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Spanish National Police (Policía Nacional): https://www.policia.es

- Grupo de Delitos Telemáticos" (GDT) email: gdt@guardiacivil.org

- Online form: https://www.guardiacivil.es

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Contact local police

- Phone: 114 14

- Online information:

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Japan Anti Fraud Organization: https://japanantifraud.org/report-a-fraud-in-japan/

- Police advisory service for non-emergency: #9110

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Internet safety concern: https://report.netsafe.org.nz/hc/en-au/requests/new

- Cyber security issues: https://www.cert.govt.nz/report/

- Phone: 0800 CERT NZ (0800 2378 69)

- Phone: 111 Immediate threat (emergency no)

- Phone: 105 (non emergency)

Reporting the scam on Truecaller will help prevent others from becoming victims.

- UAE Cybercrime Reporting: https://www.ecrime.ae

- Dubai Police: https://www.dubaipolice.gov.ae

- Abu Dhabi Police: Contact Aman Service 8002626 (tollfree)

- Email: cert@ae.gov.ae.

- Al Ameen Service (Dubai & UAE-wide): Call 8004444

- Email: www.alameen.ae (report anonymously)

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Criminal Intelligence Service Austria: https://www.bundeskriminalamt.at/en/602/start.aspx

- European Anti-Fraud Office: https://anti-fraud.ec.europa.eu/olaf-and-you/report-fraud_en

- Fraud Prevention Office: https://www.bmf.gv.at/services/aemter-behoerden/abb.html

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Dublin Jury Office: +353 1 798 8008

- Email: dublinjuryoffice@courts.ie

- Local police

Reporting the scam on Truecaller will help prevent others from becoming victims.

- General emergency telephone number: 112

- Online: www.cybercrime.bg

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Anti-cybercrime department – cambodian national police email: accd.cdiss@police.gov.kh

- Phone: +855 12 961 966 (cybercrime unit)

- Local police

Reporting the scam on Truecaller will help prevent others from becoming victims.

Conclusion

Cryptocurrency scams are causing significant financial and emotional harm to innocent people worldwide. Always be cautious when contacted by strangers offering investment ideas with huge profits and low risks, as this is usually a red flag. Invest only through secure websites and trusted organizations, and thoroughly research them before investing your hard-earned money. Avoid downloading apps, clicking on suspicious websites, or sharing sensitive information.