Vishing Scams

What is vishing or 'voice' phishing scams?

In our fast-paced digital world, scams have evolved beyond traditional email phishing to include a newer threat known as "vishing," or voice phishing. Vishing involves deceiving people over the phone to extract personal information or money. This tactic has become increasingly sophisticated, requiring individuals to understand and protect themselves from these deceptive practices.

Vishing operates through social engineering, where scammers impersonate trusted entities like banks, government agencies, or tech support. They exploit voice communication to create urgency or fear, compelling victims to disclose sensitive details without verifying the legitimacy of the call. It's essential for everyone to stay vigilant and adopt practices that ensure personal information remains secure in the face of these evolving scams.

Vishing scams examples

In these scams, fraudsters pose as representatives from banks, credit card companies, or other financial institutions. They typically claim there's been suspicious activity on your account or offer a special promotion. They'll then try to extract sensitive information like account numbers, PINs, or passwords.

Scammers pretend to be from well-known tech companies like Microsoft or Apple, informing you of a problem with your computer or software. They may claim your device has been infected with a virus or hacked and offer to help fix the issue remotely. Their goal is to gain access to your computer or trick you into paying for unnecessary services.

In these scams, callers impersonate government agencies such as the IRS, Social Security Administration, or immigration services. They may threaten legal action, deportation, or suspension of benefits if you don't provide personal information or pay supposed fines or fees.

Scammers exploit people's generosity by posing as representatives from legitimate charities or disaster relief organizations. They'll solicit donations over the phone, often using high-pressure tactics or emotional appeals. However, the money doesn't go to the intended cause but instead lines the scammer's pockets.

Fraudsters claim you've won a lottery, sweepstakes, or valuable prize but require you to pay taxes or fees upfront to claim your winnings. They may pressure you to provide bank account details or send money via wire transfer, only to disappear once they've received payment.

How to spot a vishing scam?

- Unexpected calls:

Be cautious of unsolicited calls, especially those claiming to be from banks, government agencies, or tech support. Legitimate organizations typically don't initiate contact out of the blue to request sensitive information. - Caller ID spoofing:

Scammers may manipulate caller ID to display a legitimate-looking number, making it appear as though the call is from a trusted source. - Urgency or threats:

Vishing scammers often create a sense of urgency or fear to pressure victims into immediate action. They may claim your account has been compromised, there's a legal issue, or you'll face consequences if you don't comply. Be wary of high-pressure tactics designed to make you act without thinking. - Request for personal information:

Be cautious if the caller asks for personal or financial information, such as account numbers, Social Security numbers, passwords, or PINs/ OTP. Legitimate organizations typically won't request such sensitive information over the phone. - Unsolicited offers or prizes:

If the caller offers unexpected prizes, lottery winnings, or special promotions but requires payment or personal information upfront, it's likely a scam. Remember, legitimate prizes or offers won't require you to pay or provide sensitive details to claim them. - Poor grammar or scripted conversations:

Pay attention to the caller's language and tone. Scammers may use scripts and exhibit poor grammar or pronunciation. They may avoid directly answering questions or providing vague responses when pressed for details. - Verification process:

If you're unsure about the legitimacy of a call, ask for verification. Hang up and independently verify the caller's identity by calling back using a trusted number from official sources, such as the organization's official website or documents. - Trust your instincts:

If something feels off or too good to be true, trust your instincts and proceed with caution. Don't hesitate to end the call if you're uncomfortable or suspicious.

Steps to take after a vishing scam

- If you're still on the phone with the scammer, end the call immediately. Do not engage further or provide any additional information.

- If you've disclosed any sensitive information such as passwords, account numbers, or Social Security numbers, take steps to secure your accounts. Change passwords for affected accounts and monitor your bank and credit card statements for any suspicious activity.

- Inform your bank, credit card company, or other financial institutions involved if you've provided sensitive financial information. They can help monitor your accounts for fraudulent activity and may advise you on further steps to take.

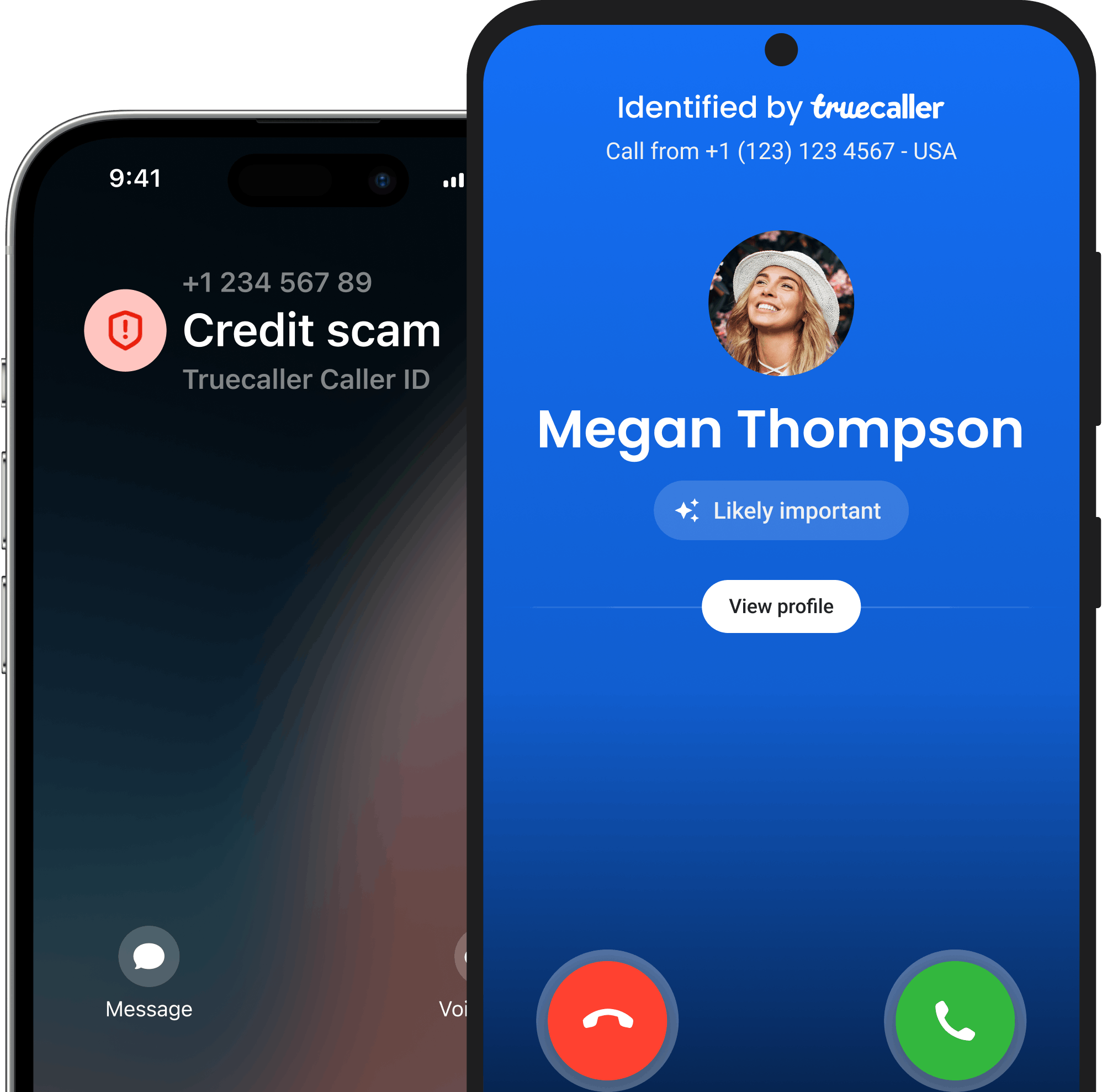

- Share your experience with friends, family, and community members to raise awareness about vishing scams and help prevent others from falling victim. Mark the number as spam, leave comments on Truecaller, and urge others to do the same.

- If you're concerned about potential identity theft, consider signing up for a credit monitoring service. These services can alert you to any suspicious activity on your credit report.

- It's natural to feel shocked, embarrassed, or even angry if you realize you've been scammed. However, it's essential to remain calm and focus on resolving the situation.

Whom to report to after a vishing scam?

If you've been a victim of a vishing scam, reach out to

- Your local law enforcement agency.

- Consumer protection agencies.

- Elder Fraud Hotline (for seniors)

- Download Truecaller for future safeguarding. It has an extensive community and also shares regular scam alerts to its app users. Also, report the number here so that the community is also safeguarded.

Country wise reporting authorities

If you are in the United States, these could be some agencies you could reach out to:

- Federal Trade Commission (FTC): You can file a complaint with the FTC online at https://www.ftccomplaintassistant.gov/

- Internet Crime Complaint Center (IC3): You can file a complaint with the IC3 at https://www.ic3.gov/

- Identity Theft Resource Center (ITRC): https://www.idtheftcenter.org/

- Better Business Bureau (BBB) (also works for Canada): https://www.bbb.org/

- fraud.org

Reporting the scam on Truecaller will help prevent others from becoming victims.

- For immediate assistance and guidance on cyber fraud, call 1930 (toll-free)

- File a cyber crime report on

https://cybercrime.gov.in/ or

https://sancharsaathi.gov.in/sfc/Home/sfc-complaint.jsp - Access the list of state-wise nodal officers and their contact details from

https://cybercrime.gov.in/Webform/Crime_NodalGrivanceList.aspx

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Police Special Fraud Unit (PSFU)

Email: report@specialfraudunit.org.ng, pro@specialfraudunit.org.ng

Whatsapp: 08127609914

Voice Call/SMS: 07082276895

Social Media: Facebook - Economic and Financial Crimes Commission (EFCC)

Email: info@efcc.gov.ng

Phone number: +234 8093322644, +234 (9) 9044751

Social Media: Facebook, Twitter, Instagram - Independent Corrupt Practices Commission (ICPC)

Email: info@icpc.gov.ng

Phone number: 08076369259, 08076369260

Social Media: Instagram, Twitter, Facebook

Reporting the scam on Truecaller will help prevent others from becoming victims.

- Action fraud: https://www.actionfraud.police.uk/charities

- Fundraising regulator: https://www.fundraisingregulator.org.uk/complaints

- GOV.UK: https://www.gov.uk/report-suspicious-emails-websites-phishing

- National cyber security centre: https://www.ncsc.gov.uk/

Reporting the scam on Truecaller will help prevent others from becoming victims.

- CSA Singapore: https://www.csa.gov.sg/cyber-aid

- File a police report at https://eservices1.police.gov.sg

Reporting the scam on Truecaller will help prevent others from becoming victims.

Conclusion

Remember that falling victim to a scam does not reflect your intelligence or judgment. Fraudsters use sophisticated tactics to manipulate and deceive even the most cautious individuals. By taking proactive steps and seeking assistance when needed, you can mitigate the impact of a vishing scam and work towards restoring your peace of mind.